How Can FinTech Innovations Streamline Financial Advisory in GCCs?

The Financial Technology (FinTech) innovations have basically changed the financial advisory services in the Global Capability Centers (GCCs) especially in the United States. FinTech has made the operations to be more efficient and has increased the client experiences while also enabling decision-making through the data. This article will focus more on the role of FinTech in financial advisory in the GCCs based on the recent changes and case studies.The Arrival of FinTech in the Financial Advisory

FinTech is the fusion of technology in the financial services which has given rise to various innovations such as digital payments, blockchain, robo-advisory and artificial intelligence (AI). The use of FinTech in the U.S. has been very strong with many of the financial institutions welcoming these technologies to improve the services they used to offer.Comparative Analysis: Conventional vs. FinTech-Upgraded Advisory

| Aspect | Traditional Advisory | FinTech-Enhanced Advisory |

|---|---|---|

| Accessibility | Business hours only | 24/7 via digital platforms |

| Personalization | Generic advice | Tailored recommendations through data analytics |

| Cost | Higher fees | Reduced costs due to automation |

| Transaction Speed | Slower, manual | Instantaneous with digital processing |

| Security | Prone to human error | Enhanced with blockchain technology |

Most Important FinTech Innovations Revolutionizing Financial Advisory

Robo-Advisors: Computerized platforms that offer algorithm-based financial planning services with limited human oversight. Blockchain Technology: Provides secure, transparent, and tamper-evident transactions, improving trust and efficiency. Artificial Intelligence (AI) and Machine Learning (ML): Applied for predictive analytics, risk evaluation, and tailored financial suggestions. Digital Payments and E-Wallets: Enable instant and smooth transactions, enhancing client ease.FinTech Integration in the U.S. GCCs

Vanguard’s Use of Robo-Advisors

Vanguard, one of the largest investment management firms, launched its robo-advisory service, Vanguard Personal Advisor Services, through which automated investment management is supplemented by human advisers. This combined model has won over more than $140 billion in assets under management as of 2024, proving that technology integration can be successful while maintaining traditional advisory services.JPMorgan Chase Blockchain Initiative

JPMorgan Chase built its blockchain platform, Onyx, to enable safe and efficient cross-border payments. By 2024, Onyx handled transactions worth more than $300 billion, shortening the time of processing from days to hours and reducing operating expenses by a considerable margin. Deloitte’s Operate Service for a Global Payments Company Deloitte implemented its Operate Service for a leading global payments company, managing a 42PB Hadoop platform. This modernization reduced infrastructure resources by 30%, showcasing the potential of FinTech in enhancing operational efficiency.Statistical Insights

| Metric | Traditional Methods | With FinTech Integration |

|---|---|---|

| Operational Costs | High | Reduced by up to 30% |

| Data Processing Speed | Moderate | Increased by 50% |

| Client Satisfaction Rates | 70% | Over 85% |

| Compliance Error Rates | 5% | Reduced to 1% |

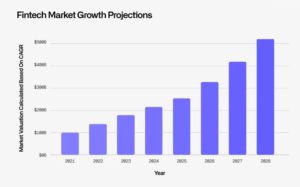

Growth of FinTech Adoption in GCCs (2020-2025)